|

Cartoons of

Dan McConnell

featuring

Tiny the Worm

Cartoons of

David Logan

The People's Comic

Cartoons of

John Jonik

Inking Truth to Power

|

Support the WA Free Press. Community journalism needs your readership and support. Please subscribe and/or donate.

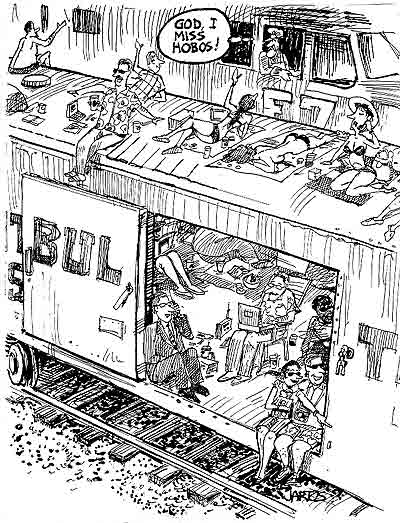

image by George Jartos

from March/April 2009 issue, posted Mar 15, 2009

What People Really Need

The Stimulus Package is wasteful and probably doomed; cutting consumption is the key to economic recovery

By Doug Collins

The economy has tanked basically because we Americans--on average--have spent far more than we've earned in the past few decades. We've lived high on credit card debt, outsized home and car loans, "rent to own" furniture and zero-interest-monthly-payment big-screen TVs. Every social class has been guilty of spending tomorrow's money today.

In the mainstream media, pundits simply assume that huge stimulus and bailout spending--the sooner the better--is the only solution: let's create jobs and shop our way out of this mess.

What few pundits seem to mention is that the government is now spending beyond its means in the most mind-numbing way. The response right now is mostly to spend yet more of tomorrow's money in bailout schemes for hand-picked cronies in big banks and big industrial corporations.

At the very best, this is a continuation of our same cultural overspending problem. The mistaken assumption of perhaps most Americans is that we need the Stimulus Package to preserve the flow of marketable products and continue the credit to buy them with.

This bailout/stimulus strategy has been favored by Bush, Obama, and obviously most elected officials. If McCain had won the presidency, I'm sure he'd be doing basically the same thing.

But guess what. The banks and the jobs will be lost anyway. The bailouts are just prolonging their demise, for the simple reason that the country hasn't lowered its consumption to meet its production. Most politicians don't want to face this reality, because it doesn't sell well with voters.

Meanwhile, the current huge government spending has only been made possible by the electronic equivalent of printing money and by the selling of IOUs--treasury bonds--to foreigners, notably to the Chinese. In the long run, this could create inflation, which is a back-door tax on every working stiff. If it doesn't cause inflation, then you can bet on huge overt tax increases.

So who's paying for the bailout? You are, one way or another. That's because most policy makers are horrified by the short-term prospects of simply erasing the debts by letting the zombie corporations fail.

In the short run, the bailout/stimulus strategy may appear to preserve or even create some jobs by keeping the money flowing. But money flowing that way is likely to become worth less and less.

Sooner or later, the public has to bite the bullet: the fact is that we won't again be seeing all those jobs, all those loans, all those cars, and all those supermalls. In fact, the public will eventually come to understand that we don't need many of those things anyway.

Instead, we really need to balance our production and consumption. There are two general approaches to doing this:

1. Lower our consumption, and

2. Raise our production, the production of things that people around the world want to buy.

Although it's quite possible to pursue both approaches at the same time, let's explore what would happen if we just focused on lowering our consumption at all levels of society.

At the governmental level, we'd have to severely curb government spending. No bailouts and no stimulus. Balance the national spending with the national revenues. Become much less dependent on financing our country with bonds. In the short run, this would cause a lot of job losses, a lot of failed banks, and a lot of pain, but in the long run, it would allow the timely death of sick corporations and put our economy more quickly on firm ground. It would also get us out of Iraq and Afghanistan quickly.

A medical metaphor suits this situation very well. The bailout strategy is aimed at keeping terminally ill corporations on life support in hopes that they will miraculously recover, in much the same way that our heroic health care system treats terminally ill patients--also at great expense but with little success. Miraculous recoveries are a pretty bad bet. Death with dignity would be the better choice. After all, economic life goes on, and new corporations will be born.

The Stimulus Package also resembles a big public anesthetic, temporarily relieving us of the personal pain of downsizing.

It's not easy lowering our individual consumption. In our households, we'd have to drastically curtail our spending and learn to make do with what we have. We could not run to the department store every time we have a whim. We'd have to be inventive. We'd have to think about how we can solve our needs, wants, and desires in simpler, cheaper ways with materials that we have at hand. Goodness knows there are a lot of materials already lying about. Heck, you can actually build nice houses out of discarded wooden pallets. The internet has plenty of plans for them.

We'd have to eat basic foods and cook them ourselves, rather than go to restaurants so much. We'd have to be closer to family and friends because we'd need the know-how of others. After all, many Americans don't currently even know how to cook.

In the short term, this will require lots of often uncomfortable adjustments. On the bright side, it will make us smarter, more skilled, and more socially connected.

The other approach to balancing our economic life is to increase production. Since the government is essentially a spender--not a producer--there are only a few things for the government to do here, such as encourage efficiency, maintain a reasonable infrastructure, ensure educational opportunities, and provide a basic social safety net. The government can also work toward realistic currency exchange rates with other countries, though this has historically been very difficult.

The real increases in productivity can only come from new businesses with new ideas. It's hard for these new businesses to get started unless the old, sick corporations that dominate the markets are allowed to die, and unless the skewed currency relations with China normalize. In the past couple decades, US producers have had an extremely difficult time competing with the low, low yuan.

But if we spend less money on Chinese imports, and save our money rather than live on credit, the unhealthy economic relations that allow the yuan to stay low will start changing in favor of US producers. On an individual level, necessity will again be the mother of invention. By scaling back our consumption, we have to become more inventive in all respects. This inventiveness will fuel ideas for future successful businesses.

If you haven't noticed already, the changes that come about from lowering our consumption also tend to raise our productive ability.

I don't think that would be true the other way around: if we focused on raising our production of goods (and not lowering our consumption) we would do nothing to stimulate our inventive thinking. We'd probably be producing the same junk we're already producing. And we'd still face the unabated problem of Chinese making the same sort of junk for a lot cheaper. At that point, we could try to bolster domestic markets by raising tariffs on Chinese and other foreign goods. But that would likely lead to international hostilities, just as it did during the Great Depression, which preceded World War II. We should steer clear of such a course.

Our relationship with China has been a key element in this worldwide financial problem. We've been the lotus eaters and China has provided the lotuses. The best thing to do for ourselves, and for our country, is to stop eating so many lotuses, get off our duffs, and start getting creative with what we've got. Unfortunately, tax rebates, stimulus checks, and bailouts of lending institutions just encourage us to fall into the same old habits.

In our state of Washington, the legislature recently voted to give supplemental pay to those receiving unemployment compensation, as a means to stimulate the economy. I wonder if the state will even be able to afford the regular payments in a few years.

Americans should resist our spending habits by redefining ourselves not as consumers, but as inventors, and socking away--rather than spending away--our money.

We'll begin to get out of this mess as soon as most Americans realize that the solution is not about getting people shopping. Our past economy, based on marketing and retail, was a dead end. We need to turn the other direction.*