by Mark Worth

The Free Press

An article in the March 1993 issue of the Washington State Bar News - the Washington State Bar Association's monthly magazine - is so reality-bending that not excerpting from it would represent a breach of our agreement to bring you glimpses of the unusual.

In typically dispassionate legalese, Central Washington University economics professor Wolfgang W. Franz explains several methods used by the courts to figure out - in case you die or are injured by the hand or fault of another - how much you value your own life.

Dollar awards intended to compensate the maimed or the family of the wrongly put-to-death for the loss of enjoyment of life are called "hedonic damages." And, you betcha, there's a full-blown debate in the legal community as to how such a figure should be calculated.

The method Franz focuses on is called the "willingness-to-pay," or WTP approach.

"The WTP approach looks at how consumers and workers value their own lives as they show implicitly by their daily actions," Franz writes.

Within the WTP approach, three formulas have evolved:

This wage premium, combined with the probability of losing one's

life on that particular job, has been used to estimate the value that

individuals place on their own lives.

For example, if a security guard is willing to work in a riskier

neighborhood where the probability of being killed on the job increases

from 1 per 2,000 to 1 per 1,000 per year, and he is willing to take this

job for an extra $3,000 of pay per year, the security guard implicitly

values his/her life at $3,000,000 (1,000 x $3,000).

The implicit value of life is calculated by multiplying the probability

of saving one life by the cost of the device.

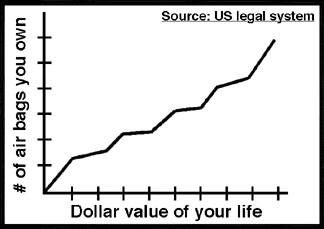

For example, assume that a consumer purchases a car with an optional

air bag for the driver which costs $600, and this air bag reduces the

chance of dying in a crash from 5 to 3 in 10,000. Reducing the chance

of dying by 2/10,000 or 1 chance in 5,000 at a cost of $600 implies that

the driver values his/her life at $3,000,000 (5,000 x $600).

According to this method, however, "a hypothetical market is posed to

the potential consumers in an attempt to determine the trade-off that they

are willing to make between risk and income.

For example, consumers have been asked what they would be willing to

pay for additional highway safety. (This method) uses surveys as the

source of data (instead of actual expenditures).

What do these formulas say your "whole life" is worth? Depending on how you want your "enjoyment of life" calculated, anywhere from about $1 million to $3.6 million, with the mean somewhere between $2.15 million and $2.5 million. Another study, funded by the US Environmental Protection Agency, came up with a range of $1.6 million to $8.5 million, according to Franz.

Once you have your "whole life value," you have to subtract your "economic value" - things like your present earnings, fringe benefits and household services - to arrive at your "hedonic value of life."

Why the deduction? "A sense of financial security is not lost if an injured person or the survivors in a wrongful-death case will be compensated for their economic losses," Franz explains, quoting another researcher.

OK, let's figure out the hedonic damages for the "average statistical person." Here's a hypothetical calculation, cited in the article, for a 38-year-old injured or dead person who otherwise was expected to live another 39 years:

| Whole-Life Value | $2,640,000 |

| + Economic Value | 948,000 |

| Hedonic Value Total | 1,692,000 |

| Hedonic Value (annual average - 39 yrs.) | $43,385 |

Have a problem with all of this? Franz offers these comforting words: "Though the WTP studies have been criticized for various reasons, there is currently no better methodology to estimate hedonic damages. The approach is based on a credible range of values which gives reasonable results."

All of you college professors, artists and brain surgeons who for whatever reason don't own home alarm systems or high-performance brake pads - did you hear that? Your lives may be "worth" less than those of $8-an-hour security guards, Manhattan cab drivers and boxing-gym sparring partners.

|

|

|

|

|

Contents on this page were published in the May, 1993 edition of the Washington Free Press.

WFP, 1463 E. Republican #178, Seattle, WA -USA, 98112. -- WAfreepress@gmail.com

Copyright © 1993 WFP Collective, Inc.